Car Loan Payment Calc Pro App – Easy Car Price/Car Loan Calculator

Are you planning to buy a car, truck or RV? Have you tried negotiating for one? And have you found it difficult and frustrating? This is because the salespersons pursue you like anything and you are badly confused about what is good for you and what is not. This makes you frustrated about how people can fool you. But this will no more the case, because you can take help of a fantastic app named Car Loan Payment Calc Pro!

What is Car Loan Payment Calc Pro?

Car Loan Payment Calc Pro or Car Loan Payment Calculator makes you an expert in negotiation while shopping for a car, truck or RV. How does it do that? It calculates an affordable purchase price or a monthly loan payment easily and quickly right on the location, on your mobile device. You can take help of it for a loan on any motor or automobile (auto) vehicle.

You would love to hear that no ads will be displayed on the app. So, there will be less discomfort and irritation for you!

Safety

Car Loan Payment Calc Pro app is absolutely safe to use because it doesn’t use your any personal information. It just asks for the minimum permissions required to carry out its functions.

Car Loan Payment Calc Pro can be shifted to the SD card too. This is the paid/professional version of the car loan payment calculator app.

How to Use Car Loan Payment Calc Pro App?

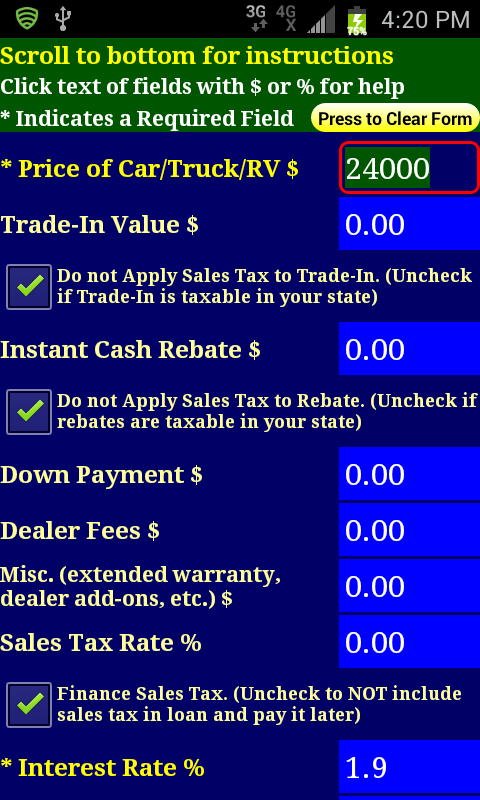

When you will open the app, simply select things you want to calculate on the start screen, like:

- If you will be purchasing from a dealer – monthly loan payment

- If you will be purchasing from a person – monthly loan payment

- The cost of a car/RV/truck which you can afford according to the monthly payment you desire

Next, you just enter the necessary information (for example, price, term of loan, interest rate) and any optional information (for example, sales tax rate, trade-in, loan pay-off, rebate etc).

Now hit the “calculate” button.

The paid version enables you to save all the numbers that you enter and doesn’t show any ad, unlike the free version.

Why Calculating Auto Loan Value is Important?

Calculating auto loan value is important since it states the maximum amount that can be financed on a used or new vehicle purchase, in relation to the book value of the automobile or MSRP (Manufacturer’s Suggested Retail Price). Loan value is set in order to let the lender limit the amount they finance on a depreciating asset like a vehicle. Depreciation means the difference between cost of the thing when you buy it and that when you sell it. In case of a vehicle, the selling price is usually lower than the purchase price and therefore a vehicle is a depreciating asset.

3 Options on the Start Screen

You can get 3 options on the Start Screen.

1. Calculating a Monthly Loan Payment if you are buying from an auto dealer. This option enables you to enter all the items which the finance manager of the auto dealer would enter into their computer system to calculate a monthly loan payment.

You can input things like:

- Price of the car/RV/truck (this is required)

- Term of loan (months) (this too is required)

- Rate of interest (required)

- Rebate on instant cash payment (this is optional)

- Trade-in value (optional)

- Down payment (optional)

- Dealer’s fee (optional)

- Sales tax rate (optional)

- Loan payoff (optional)

- Miscellaneous, like dealer add-ons, extended warranty, etc (optional)

You are also able to choose whether to apply sales tax to rebate and/or trade-in. Also, you may select whether to finance the full sales tax, which means including it in the loan.

After you enter all this information, the app calculates your monthly loan payment as per the information. It even displays the full amount financed and full amount of sales tax.

2. Calculating a monthly loan payment if you are purchasing from a person. This version is a simplified one.

You can input information like:

- Price of the car/RV/truck (this is required)

- Term of loan (months) (this too is required)

- Rate of interest (required)

- Sales tax rate (this is optional) – this is used only for informative purposes

- Down payment (optional)

After you enter this information, the app calculates the monthly loan payment of your car according to it.

3. Calculating the affordable purchase price of the car according to the term of loan, monthly loan payment, rate of interest and other optional information if any.

You can input things like:

- Monthly payment for car/RV/truck (this is required)

- Term of loan (months) (this too is required)

- Rate of interest (required)

- Dealer’s fee (this is optional)

- Down payment (optional)

- Sales tax rate (optional)

- Loan pay-off (optional)

- Miscellaneous, like dealer’s add-ons, extended warranty, etc (optional)

Here too you can choose whether to apply sales tax to trade-in and also whether to finance to full sales tax, meaning, including it in the loan.

After you do all the required things and enter all the information, the app calculates the affordable purchase price of the vehicle according to the info you have provided and also display the full financed amount and sales tax.

The developer of the Car Loan Payment Calc Pro app is Starflower Solutions and they are happy to receive emails from you with any questions, suggestions and comments to sunflowersoft1-a@yahoo.com.

New Additions to Car Loan Payment Calc Pro App

- The rounding problem of calculation of full payments has been corrected.

- The display of text has been improved.

- The difference won’t be noticed by many though it is a value addition.

- Maximum sales tax rate has been increased to 30%.

- Maximum loan term has been increased to 180 months.

- Minimum loan term has been reduced to 6 months.

- Preference screen has been added.

- An additional button with an icon of gear has been provided to access preference screen.

If you compare other car price calculator available on the web with Car Loan Payment Calc Pro, you will notice that this app is much easier to use and less hassle-free. So, henceforth you don’t have to distress with calculating your new car’s desired price and loan value. Take benefit of Car Loan Payment Calc Pro and own a car of your choice at your desired price.